This was our event

Frankfurt’s Alte Oper once again provided the backdrop for Lupus alpha Investment Focus – the 24th edition of this long-running investor event.

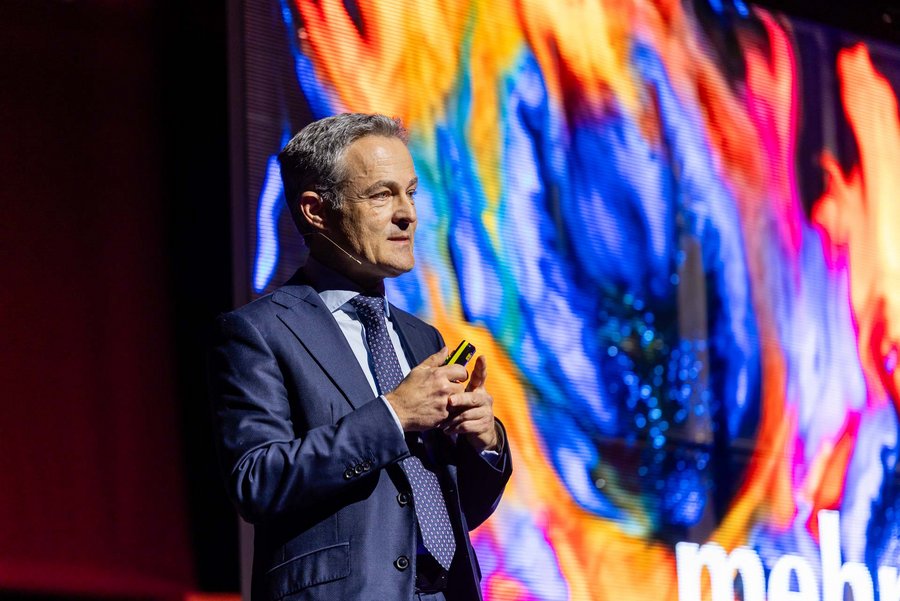

Ralf Lochmüller, CEO of Lupus alpha, stressed that the independence of the company is the basis for success and consistent focus on customer needs.

Dr. Stephan Leithner, CEO of Deutsche Börse AG: “Lupus alpha has turned small caps into blue chips with courage and expertise, thereby also increasing the attractiveness of the capital market.”

Margrethe Vestager, former EU Commissioner for Competition, said the most important thing is to complete the Single Market so that companies can operate across Europe from the start.

In the morning’s podium, there was agreement that investment in innovation is crucial to generating new business models and economic dynamism.

Verena Pausder, chairwoman of the Start-up Association, emphasised that with 0.1% of GDP currently being spent on innovation, no new business models are emerging – in the past, this figure was 4%.

ntv policy expert Nikolaus Blome stated that politics must finally shift a gear higher – away from small-scale measures to bold decisions.

Christian Lindner, former Federal Minister of Finance, said that competitiveness does not come from government programmes, but from companies with top-quality products.

From a small- and mid-cap specialist to a multi-specialist with six focused asset classes away from the mainstream, Lupus alpha has evolved in 25 years.

Dr. Götz Albert, CIO at Lupus alpha, stressed the attractive return opportunities of European small and mid caps and recommended that they be included as an integral part of any asset allocation.

Portfolio Manager Marc-Alexander Knieß highlighted the benefits of global convertible bonds, which enable asymmetric equity market participation in exciting growth sectors.

Portfolio Manager Stamatia Hagenstein introduced CLOs: a robust structure with attractive returns, no interest rate risk and high quality – a combination of stability and income.

Alexander Raviol, CIO Alternative Solutions, recommended hedging strategies to target risks in the portfolio while taking advantage of opportunities in the equity market.

Marvin Labod, Head of Quantitative Analysis, explained the advantages of low-cost risk overlays – an indispensable hedge for portfolios in any market phase.

Zanny Minton Beddoes, editor-in-chief of The Economist, warned that Europe only has a narrow window of opportunity to develop its clout. Otherwise, there is a risk of decline.

Gary Gensler, former chairman of the SEC, stressed that independent institutions like the Fed are important for stable markets and confidence in democracy.

The capital markets podium showed that, despite geopolitical risks and uncertainties, professional investors see opportunities in Europe, Asia and selected sectors.

Armin von Buttlar, Executive Board of Aktion Mensch e.V., emphasised the importance of quality and risk management, remains faithful to his long-term strategy and focuses on diversification.

Bernd Franken, managing director of capital investment at Nordrheinische Ärzteversorgung, sees confidence in the dollar as the biggest short-term risk. He rejects crypto as mere speculation.

Carsten Roemheld, Capital Market Strategist at Fidelity International, warned that euphoria should not obscure structural risks as equity markets rise.

Hans Joachim “Aki” Reinke, CEO of the Union Investment Group, pledged a generous donation to the association “Die Arche”, which is dedicated to disadvantaged children in Germany.

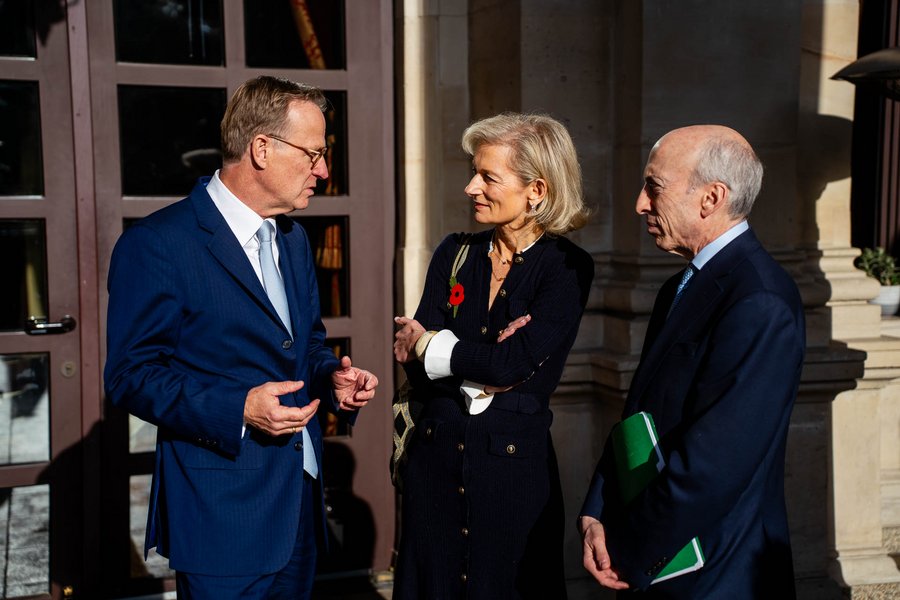

Ralf Lochmüller with former SEC chief Gary Gensler and Zanny Minton Beddoes, editor-in-chief of The Economist.

Ralf Lochmüller chats with clients at Lupus alpha Investment Focus.

Ralf Lochmüller thanks the day’s host, Corinna Wohlfeil from ntv. We look forward to seeing you again on 5 November 2026.