In a quarter of a century, much has changed in capital markets, in capital investment and also in lupus alpha itself. What started as a small & mid cap specialist is now a multi-specialist with the aim of creating real value for clients in specialised asset classes outside the mainstream.

There are constants that characterise all portfolio managers and their strategies at Lupus alpha: a great passion for asset management; deep specialisation in the respective asset class; and the ambition to achieve sustainable results through consistently active management. A look at current strategies shows how diverse and practical this added value looks today:

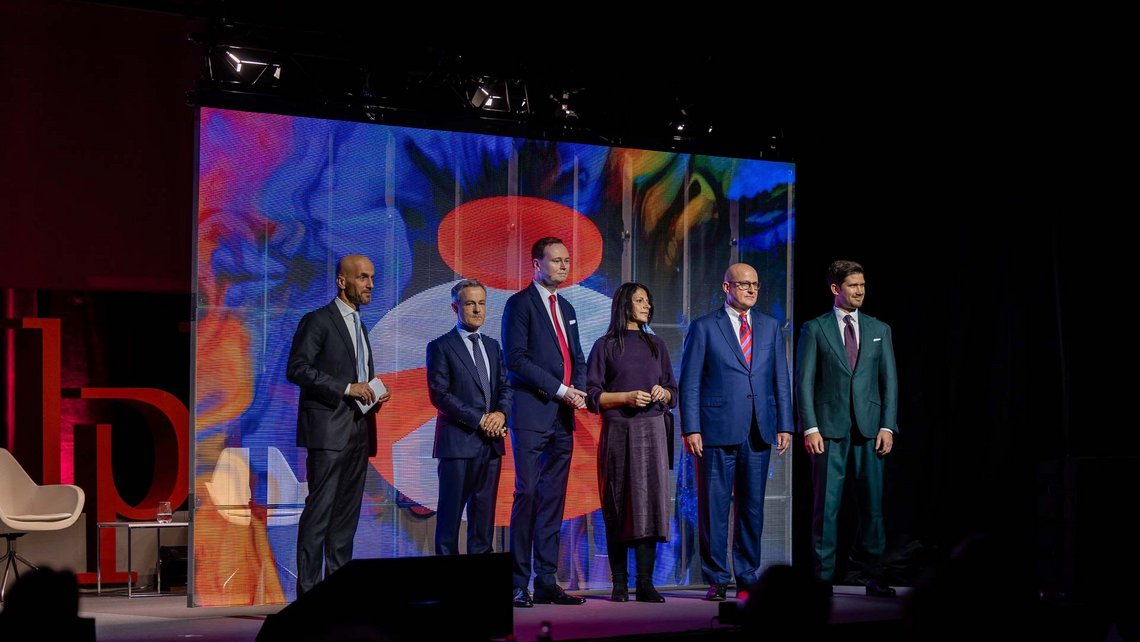

European small & mid caps

Dr. Götz Albert, CIO at Lupus alpha, highlighted the importance of SMEs and described the diversity and growth opportunities in the European small and mid caps segment: “Diversity enables growth”. Please keep in mind that you always invest in the real economy with small caps. This asset class, with its return opportunities, should be part of any strategic asset allocation – especially today when it’s valued so cheaply.”

Global convertible bonds

Portfolio Manager Marc-Alexander Knieß emphasised the asymmetrical participation in equity market themes in the bond portfolio for convertible bonds and stressed the importance of experience and global network in fund management: “Our convertible bond strategy has yielded around 9% per year over the past three years and has been able to significantly increase investors’ capital when adjusted for inflation.”

CLOs – Securitised corporate loans

Portfolio Manager Stamatia Hagenstein introduced CLOs in response to complex markets:

“CLOs mean: The most robust corporate loans bundled into one portfolio. These structures are stable.” She then cited three reasons for CLOs in the portfolio: attractive yield, no interest rate duration and high quality. She stressed: “Over the past ten years, investment grade CLOs have cumulated no defaults – a black zero.”

Value protection strategies

Alexander Raviol, CIO Alternative Solutions at Lupus alpha, stressed that classic bonds have lost their previous role as a return driver: “Bonds have left a big gap. This is closed by Lupus alpha’s hedging strategies.” Derivatives and option strategies can be used to limit the risk in the portfolio without sacrificing the opportunities of the equity market.

Volatility strategies

Alexander Raviol then stressed the importance of volatility strategies for the diversification of an institutional portfolio. He explains that these strategies provide long-term returns and behave differently from traditional investments in different market phases.

“Diversification is more important than ever today – this leads you directly to Lupus alpha volatility strategies.”

Overlay strategies

Marvin Labod, Head of Quantitative Analysis, explained the benefits of a risk overlay that reduces drawdowns while keeping costs down by generating additional income. Historically, the benefits of risk overlays have often been questioned in quiet market phases. However, events such as the coronavirus pandemic and the war in Ukraine have demonstrated that the right time for an overlay can never be predicted. Labod: Every portfolio deserves an overlay – and not just any overlay, but ours.”